|

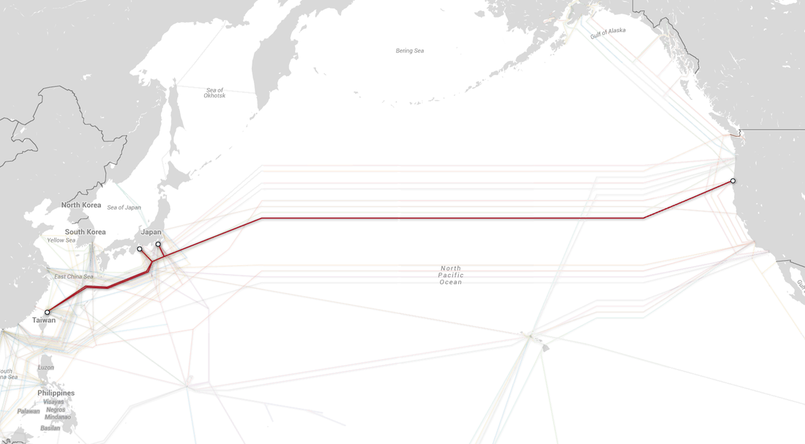

A consortium of six companies has announced that the FASTER cable system is ready for service. FASTER Cable Map Source: TeleGeography

The companies - consisting of China Mobile International, China Telecom Global, Global Transit (TIMEdotCom), Google, KDDI, and SingTel - along with supplier NEC Corporation, said construction and end-to-end testing of the cable has been completed and will begin service June 30, 2016. Spanning 9,000km across Japan and the West Coast in the US, FASTER claims to be the first transpacific submarine cable system designed to deliver 60 Tbit/s of bandwidth using a six-fibre pair cable across the Pacific. "The completion of the FASTER cable system will provide capacity to support the expected four-fold increase in broadband traffic demand between Asia and North America," said Ooi Seng Keat, vice president of carrier services at Singtel Group Enterprise. "By adding network redundancy and ultra-low latency to our existing trans-Pacific cable systems, it reinforces our leadership in international data services in the region and enhances our infrastructure to support our customers’ critical data traffic." The cable lands in Oregon in the US as well as two landing points in Japan, namely Chiba and Mie, and Tanshui in Taiwan. The two landing points in Japan are said to enable the cable’s easy access to major cities in Japan as well as other Asian locations. The system is also said to have extended connections to major hubs on the West Coast of the US covering Los Angeles, the San Francisco Bay Area, Portland and Seattle. Source: Capacity Media ANALYSIS: Google's preference to operate in this market under a shroud of secrecy has contributed to some surprise from the industry at the apparent speed with which this project has been implemented. However, it is just over two years since the first public announcement that China Telecom had signed a Construction & Maintenance Agreement for this system and presumably there were some months of planning and negotiating with the other consortium members before that. A three-year time frame for a consortium cable with a limited number of members is about par for the course. Each member will get one fiber pair cable carrying 10 Tbit/s using 100 Gbit/s wavelength technology. However, JRC suspects that Nokia ASN has already been called upon to upgrade FASTER to 400 Gbit/s wavelength technology. There is no empirical data to make a judgment as to what additional yield of capacity this upgrade could bring. It could be as much as four times but it could be less, depending on the spectral efficiency that ASN has been able to achieve on a system manufactured by NEC and its cable manufacturing subsidiary, OCC. Moreover, since each consortium member controls a fiber pair, ASN's contract could be with only one or a number of the members. The quote from SingTel's Seng Keat does not indicate over what period he expects a four-fold increase in demand but we estimate that transpacific demand is growing at around 55% per year which would see a four-fold increase in the space of the next three years. Looking at the composition of the FASTER consortium, it represents significant shares of major markets in China, Japan, Singapore, & Malaysia, not to mention the demand from Google as a content provider. Significant Asia Pacific markets that are not included are Indonesia, Philippines, South Korea, and Australia but demand from these markets will soon be addressed by other new transpacific cables, namely SEA-US, NCP, and Hawaiki. Under this scenario, it would not be unreasonable to expect an acceleration in erosion of the price of transpacific bandwidth which JRC estimates is currently running at around 3-5 times the cost of equivalent transatlantic bandwidth. The unknown factor is how the other major content providers will react to Google's move. Amazon has invested heavily in capacity on Hawaiki but Microsoft and Facebook have, so far, not been involved in the transpacific market. If they buy capacity on the above-mentioned new cables, this will provide some support for prices but if they choose to build or support additional transpacific cable initiatives, as they have in the transatlantic market, price erosion will increase.

0 Comments

Leave a Reply. |

Julian Rawle, AuthorThought leadership articles and commentary on developments related to the subsea fibre optic cable industry can be found here. Archives

February 2018

Categories |

RSS Feed

RSS Feed