|

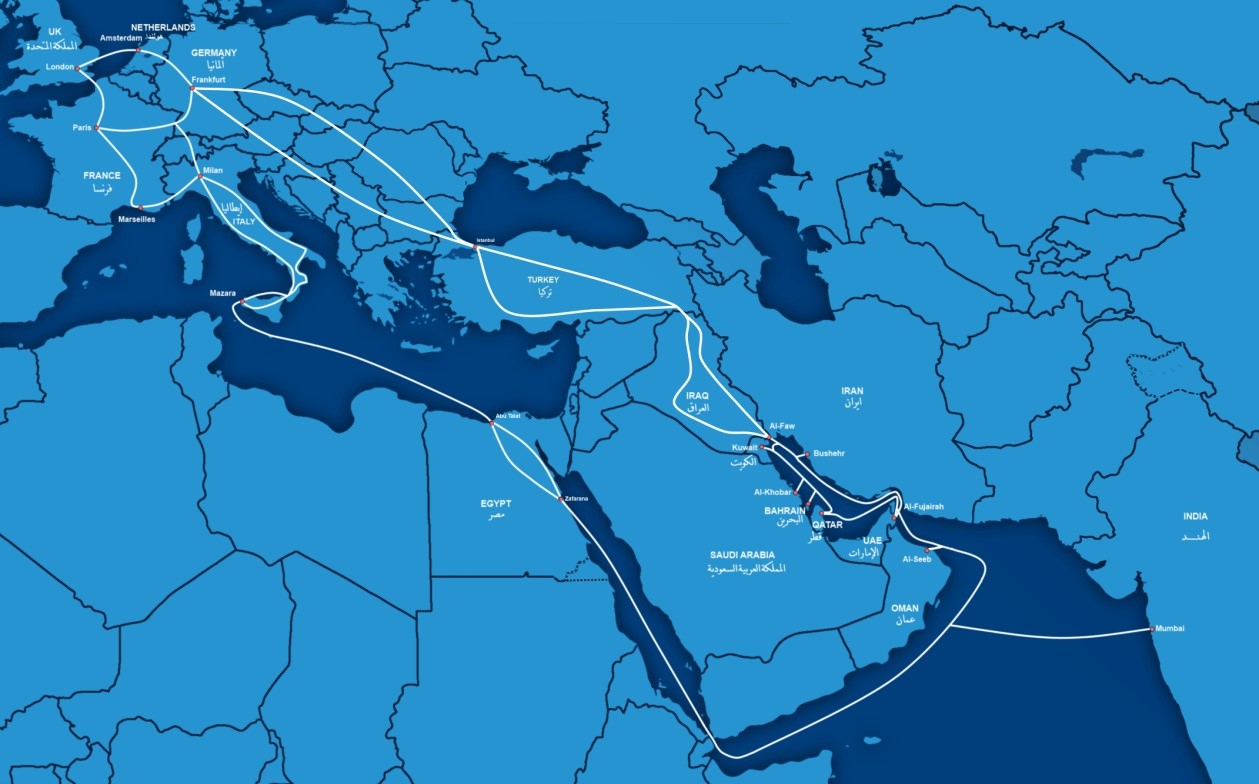

GBI announced the finalization of a significant loan refinancing deal that will allow the company to explore new business and investment opportunities and to further support its successful transformational journey. GBI sealed QAR1 billion (US$285 million) loan refinancing deal with a major financial house in Qatar and the Arabian Gulf. Abdulla Al Rwaili Executive Vice Chairman and Managing Director of GBI, said, “The support extended from the financial community demonstrates confidence in our innovative business model and future investment plans. The added liquidity will further support our transformation by enabling sustainable growth and enhanced financial flexibility to launch new strategies for business expansion.” Figure 8 – Gulf Bridge Cable Map Source: Gulf Bridge International

Amr Eid, Chief Executive Officer of GBI, said, ”The loan refinancing initiative comes after the capital increase by GBI’s major shareholders in Q2 2016 that reflected their confidence and aspirations in GBI’s unique transformation into a true global service provider. This loan will be long-term and will accelerate our ability to pursue organic and inorganic business opportunities, across different geographies and verticals.” Source: Capacity Media ANALYSIS: GBI’s main investors are Qatar Foundation (Knowledge Ventures), The Qatar Investment Authority, and The Kuwait Investment Authority. The Company’s headquarters are located in Doha, Qatar. The GBI network was commissioned in February 2012 but the business plan faced a major difficulty from the outset because it was predicated on a partnership with Egyptian cable developer, MENA, which would provide onward connectivity from the Persian Gulf to Western Europe. Unfortunately, MENA, which was originally owned by Egyptian private telco, Orascom, took seven years from award of the original supply contract to RFS because of the political unrest in Egypt which led to delays in permitting. Having finally paid Telecom Egypt for access, MENA came on stream two years after Gulf Bridge, during which time GBI struggled to make capacity sales because they could only offer intra-regional connectivity on their own network. By the time that MENA was connected, other Europe-Asia cables (TGN Gulf, Pishgaman Oman-Iran, Omran, EPEG) had been built with landing points in the Persian Gulf and GBI had lost first mover advantage. In March 2015, the CEO, Ahmed Mekky, was forced to step down. Eventually, Amr Eid was appointed to replace Mekky. As indicated above, in the middle of 2016, shareholders agreed to re-float the Company by injecting additional funds. It has taken until now to achieve debt re-financing through a mysterious financial house. MD Al Rwaili’s quote speaks of “transformation” and “new business strategies”, indicating that the original business model has now been abandoned or drastically re-designed but the recent heightened tension between Qatar and some of its neighbors will not help GBI’s prospects for a turnaround.

0 Comments

Leave a Reply. |

Julian Rawle, AuthorThought leadership articles and commentary on developments related to the subsea fibre optic cable industry can be found here. Archives

February 2018

Categories |

RSS Feed

RSS Feed