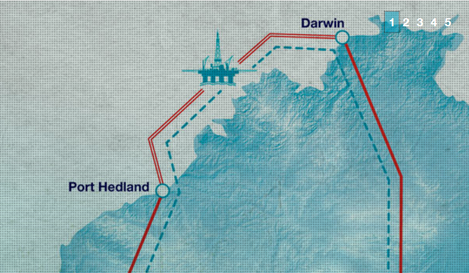

Vocus Communications Enters Conditional Sale Agreement to Buy Nextgen Group’s Network Businesses9/13/2016 Nextgen Group announced today it had entered into a conditional agreement with Vocus Communications for the sale of the company’s network businesses, including the North West Cable System (NWCS) for US$600M (A$807M). Vocus has an option to buy Nextgen's Australia Singapore Cable (ASC) project for a deferred consideration of US$40M (A$54M).The proposed sale is subject to ACCC clearance and other customary completion conditions. The deal includes Nextgen’s 17,000km national fibre network with 112 Points of Presence (PoPs), the almost-completed subsea Port Hedland to Darwin cable and the proposed Perth to Singapore subsea cable. The Group will continue to own its data centre business, Metronode, which operates as a separate entity. Pre-acquisition, Vocus had access to between 50 to 60 PoPs. "We think it would be highly unlikely that anyone would ever build a AU$1.2 billion (US$892M) inter-capital network around Australia again, so we sort of class this as a bit of an invaluable asset in that respect," Executive Director James Spenceley said in a media call. "And given its scale and reach, we put it in a class of Optus in terms of a comparison in infrastructure reach and breadth, and it really places us sort of in that -- give or take -- around the second infrastructure reach in the country now, combined with the Vocus business," he added. Vocus is expected to raise US$485M (A$652M) to fund the acquisition through an entitlement offer and placement, with the rest coming from existing debt facilities. Nextgen Group is owned by the Ontario Teachers’ Pension Plan (71%) and CIMIC Group Limited (29%). Both OTPP and CIMIC Group will retain ownership of the Group after the sale. Metronode is Australia’s leading, carrier-neutral, energy-efficient data centre provider, with 10 facilities in Perth, Melbourne, Sydney, Wollongong, Canberra, Brisbane and Adelaide. Adapted from: Nextgen Press Release, Capacitymedia.com ANALYSIS: The Australian telecom market is currently one of the most dynamic and confusing markets in the world. Telstra remains a dominant player, despite selling its retail business to the Australian Government for US$8 billion. The Government has embarked upon a "National Broadband Network" (NBN) with the aim of delivering broadband for all but has hit problems with rollout and service quality, not to mention political machinations. The ISP market has consolidated over the last few years with TPG acquiring assets to rival Telstra. Nextgen was originally intended to offer competition in the long-haul market but the Company lost its way when a majority stake was sold to the Ontario Teachers' Pension Plan and it acquired the ASC project (see Figure 9 below) from Leighton's. Further loss of focus occurred with the decision to build the North West Cable System (see Figure 10 below), an opportunistic attempt to take advantage of oil and gas company requirements for offshore telecom. Figure 9 - ASC Cable Map Source: Nextgen Vocus, a second-string telecom service provider has struggled to achieve critical mass in the Australian market and has been looking for opportunities to get involved in international submarine fiber optic projects for a number of years. Figure 10 - NWCS Cable Map Source: Nextgen

The problem for Vocus has always been funding. The company's cash flow does not support its aspirations to become a major infrastructure player. It is therefore not surprising that the Nextgen acquisition will be funded through external sources. The question remains whether existing shareholders and creditors will want to increase their exposure to fund Vocus' move into an area in which it really has little experience. Meanwhile, the long and painful story of the ASC project, which was first conceived in 2011, takes another turn. The immediate impact on the project from this announcement must be further delay as the transaction between Vocus and Nextgen goes through. One unique characteristic of the Australia-Singapore route is that competing projects do not appear to gain any advantage when one is delayed or encounters difficulties. This is because the business case for this cable system is so difficult to prove. Five years on from the first announcements of ASC and Trident, followed by the more recent announcement of APX-West, and none of these projects is showing any measurable progress towards realization.

0 Comments

Leave a Reply. |

Julian Rawle, AuthorThought leadership articles and commentary on developments related to the subsea fibre optic cable industry can be found here. Archives

February 2018

Categories |

RSS Feed

RSS Feed