|

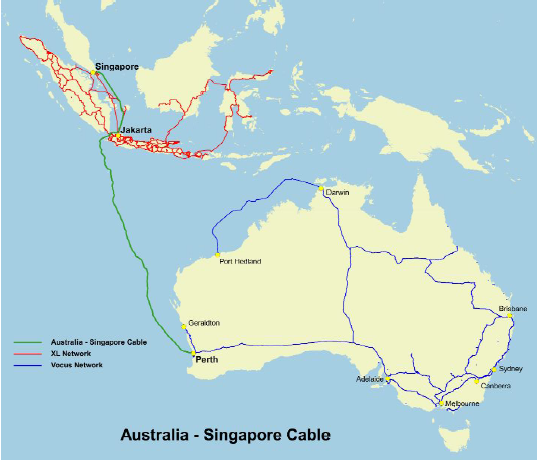

Vocus Group Limited (Vocus) announces today that it has executed a binding agreement with Alcatel Submarine Networks (ASN), referred to as contract-in-force (CIF), for the construction of the Australia Singapore Cable (ASC). Figure 14 - ASC Cable Map Source: Pioneer Consulting

The ASC project is a ~4,600km submarine cable system linking Australia to Singapore, and Indonesia, with a system design providing a minimum of 40Tbit/s of capacity from Western Australia to South East Asia, with this capacity forecast to expand via technology advancements over the coming years. Following the completion of the Nextgen Networks (“Nextgen”) acquisition, Vocus confirms that it has secured Singapore Infocomm Development Authority of Singapore (IDA) approval and renewed Landing Rights with the Ministry of Communications and Information Technology of Indonesia (MoCIT) in Indonesia, which, in combination with moving to a CIF with ASN, fulfils all necessary requirements to commence & complete the project. ASC is expected to take approximately 19 months to build, with completion targeted by August 2018. The effective life of the ASC is estimated to be a minimum of twenty-five years. ASC was a key strategic consideration in Vocus’ decision to purchase Nextgen Networks, as it, in combination with Nextgen’s trans-Australian fibre network, creates a fully interconnected, high capacity fibre network owned by Vocus from the East Coast of Australia through to Singapore (via Perth), with direct connectivity into Indonesia (population 230m+). In combination with the Nextgen network, ASC delivers Vocus a unique competitive advantage which provides a platform to increase utilization of both assets. The ASC project is expected to cost ~US$170M over the build period. This includes US$130M to ASN, US$20M payment due on completion of the project to Ontario Teacher Pension Plan and approximately US$20M in civil works, operating costs & ancillary costs during the ASC build period Payments made during FY17 will be funded from existing debt capacity, while payments made in FY18 and beyond will be funded from a combination of existing debt capacity, operating cash flow and expected customer pre-payments for Indefeasible Rights of Use (IRU) agreements. Vocus currently expects to receive IRU pre-payments of approximately $US100M during the build period. In a report commissioned on the ASC project in early 2016, telecom data market experts TeleGeography estimated demand for bandwidth between Australia and Asia would exceed 50Tbit/s by 2029. The report estimates ASC has the opportunity to capture a minimum of 15.5Tbit/s of capacity sales by year-end 2029, resulting in expected revenues of at least US$550M over this period, by which time ASC will have been operating for only 40% of its effective life. TeleGeography estimates that by 2019, 30 percent of Australia’s overall international bandwidth will be connected to Asia. Demand for data capacity on the ASC route is growing rapidly and the only other comparable cable system is nearing full capacity. This growth in data consumption, particularly in the Asian region, places ASC in a strong position given it is the most progressed new cable project on this route. The investment case for ASC is underpinned by strong demand, the need for diversity and resilience for both the Australian and Asian markets, and the fact that ASC will connect Australia to Southeast Asia, India, and Europe at lower round-trip times, outperforming any other existing cable system. ASC has also fully executed partnering arrangements with XL Axiata Tbk in the form of a binding Landing Co-operation Agreement that provides security of tenure, commercial arrangements and nationwide coverage in Indonesia through XL’s 21,000km domestic transmission network. XL Axiata Tbk is one of Indonesia’s leading telecommunication service providers, offering mobile services and a national fibre network covering more than 90% of the population throughout Indonesia. The carrier is currently serving ~42m subscribers. Furthermore, ASC, combined with Nextgen’s trans-Australian fibre network and Vocus’ capacity on the Southern Cross cable to Los Angeles, provides a competitive alternative route for data traffic from the Indian Ocean region through to North America. Vocus will update the market on the progress of the ASC project in its 1H17 results release, to be made in late February 2017. Source: Vocus Press Release ANALYSIS: Alcatel Submarine Networks (ASN and a part of Nokia) funded the marine survey for this project in 2011 and consequently won the turnkey equipment supply tender. However, as with other attempts to connect Perth, Australia to Singapore going back more than fifteen years, the ASC project became mired in the internal politics of its original owner, Leighton's, the Australian construction firm and Leighton's subsidiary, NextGen. Matters were further complicated by the injection of funds from the Ontario Teachers' Pension Fund which led to a series of changes in management and strategic focus. Meanwhile, both Trident and SubPartners proposed building largely similar cable systems on the same route. It required a takeover of NextGen's assets by Vocus, an Australian telecom carrier with at least a strategic interest in having access to international connectivity to move this project forward and bring the supply contract with ASN into force. However, as noted above in the Press Release, Vocus will use external debt to fund this project and are banking on topping this funding up with US$100M of pre-sales. This is a challenging target to achieve on an unproven route with customers eyeing the likelihood of other systems being built and driving down prices. Nevertheless, the economics of the ASC project look reasonable. Vocus is paying ASN around US$28,000 per km. This is not the lowest price seen in the market recently but the route through relatively shallow Indonesian waters will be challenging. Capex of US$170M and revenue of US$550M over 10 years provides an internal rate of return (IRR) of 30% and a net present value (NPV) of US$150M assuming a 10% hurdle rate. The IRR is at the top end of what one would expect to see in a realistic business case for a submarine fiber optic cable and the average achievable price of US$0.31 per Mbit/s per month over the ten-year period is probably optimistic but, overall, the project appears to be economically viable. Quite apart from the initial "sweat equity" provided by ASN in the form of paying for the marine survey, it takes time and money to support a project like ASC for five years while the project's various owners try to find a viable funding solution. It is quite remarkable how ASN and their other turnkey supplier counterparts, TE SubCom and NEC, are willing to continue betting on a horse that is taking a long time to get fit for the races. The profit margins must still outweigh the risk.

0 Comments

Leave a Reply. |

Julian Rawle, AuthorThought leadership articles and commentary on developments related to the subsea fibre optic cable industry can be found here. Archives

February 2018

Categories |

RSS Feed

RSS Feed